Learn How Our Networking Service Helps a Loan Officer Grow their Network of Real Estate Agents and Referrals.

We help our loan officer customers grow and maintain a producing network of real estate agents.

Start using our all-in-one software for your business.

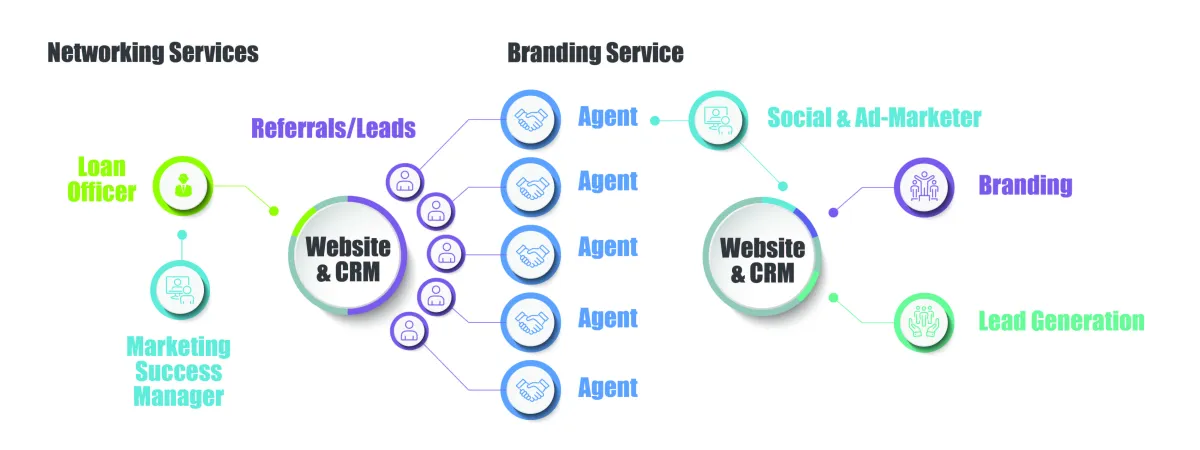

STEP 1: Networking Service

A loan officer uses our networking services to help them grow and maintain a network of real estate agent referral partners.

In the first step of our service model, loan officers leverage our Networking Services to foster the growth and maintenance of a robust network consisting of real estate agent referral partners. Through this offering, we equip loan officers with tools, resources, and support aimed at establishing and strengthening connections within the real estate community. The primary focus is on facilitating the expansion of a loan officer's network, with a specific emphasis on cultivating relationships with real estate agents capable of providing valuable client referrals.

It is crucial to note a key policy within this Networking Service framework: loan officers utilizing our services are expressly prohibited from directly paying for the products and services offered by our company to their agent referral partners. This policy serves to maintain a clear delineation between the financial transactions of loan officers and real estate agents, ensuring transparency and preventing any potential conflicts of interest.

Moving on to the second step of our service continuum, we provide Branding Services tailored for real estate agents. The overarching objective here is to empower agents in nurturing their sphere of influence and converting qualified prospects into clients through a market-by-referral approach. Our Branding Services encompass various activities, including comprehensive support for enhancing the personal and professional branding of real estate agents, strategies for effective lead generation, and a focused approach on building their business through referrals from their existing network and sphere of influence. Our Branding Services encompass a spectrum of support, including the enhancement of personal and professional branding, strategic lead generation, and the cultivation of a market-by-referral approach.

Importantly, our Branding Services operate independently and distinctly from our Networking Services, reinforcing a deliberate separation between the two service offerings. This segregation ensures that loan officers and real estate agents receive specialized attention and resources tailored to their respective needs, without any overlap or commingling of services. The intentional division between Networking and Branding Services is a key aspect of our service strategy, allowing us to provide targeted and effective solutions to both loan officers and real estate agents in their respective domains.

STEP 2: Adding Referral Partners

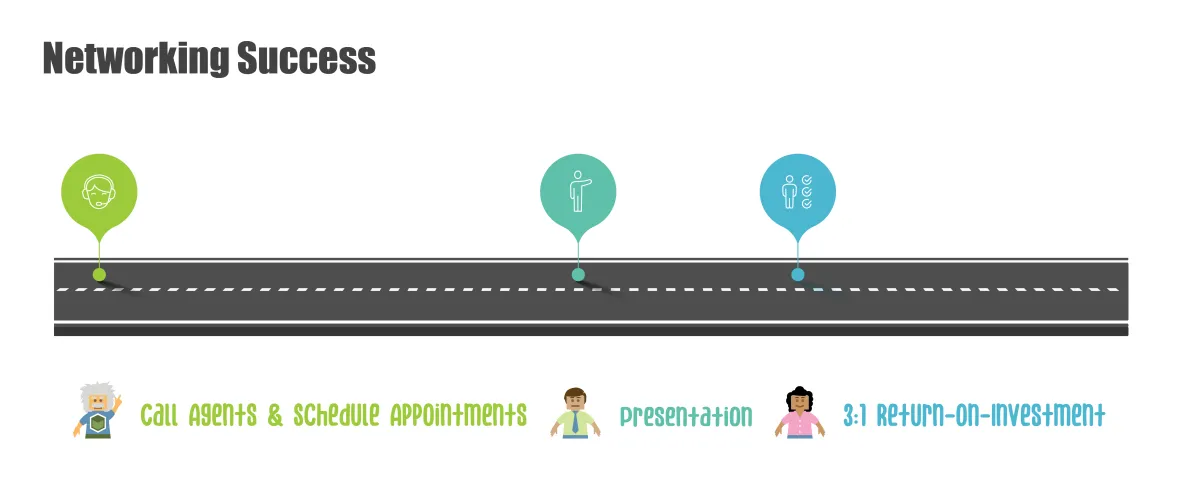

In the second phase of our service, Marketing Success Managers take an active role in guiding loan officers towards networking success. Through weekly follow-ups, we ensure that loan officers remain on course to meet their networking objectives. Loan officers, as a key part of their responsibilities, engage in weekly calls to secure appointments and gather referrals. Our dedicated Marketing Success Managers provide invaluable training, covering essential aspects such as effective networking calls, appointment scheduling techniques, and strategies for impactful initial meetings.

This comprehensive approach aims to empower loan officers with the expertise needed for effective networking, contributing to their overall success. By combining the initiative of loan officers with the guidance of our Marketing Success Managers, we create a synergistic partnership that fosters meaningful connections and facilitates the achievement of networking goals.

STEP 3: Networking Success

A loan officer has to know how to gauge a referral partners productivity and provide them solutions to find more prospective clients.

Weekly Calling Lists: In the weekly calling routine, a loan officer's success hinges on strategic identification and tracking of potential referral partners. They begin by carefully selecting agents to add to their referral network. The focus is on monitoring new referral contacts, categorizing them as "Open" for potential meetings and identifying those who express an "Interest" in collaboration. Maintaining active engagement, the loan officer conducts weekly conversations with "Active" referral partners to discuss and address their specific needs for leads and referrals relevant to the loan officer's products or services. This systematic approach ensures a proactive and targeted outreach strategy, fostering strong connections within the network of referral partners.

Weekly Appointments: In the realm of weekly appointments, a loan officer's path to establishing strong connections involves fostering genuine friendships with referral partners. One effective strategy is the personal touch of taking partners to lunch, creating an environment conducive to building meaningful relationships. Recognizing the diversity in the networking needs of each referral partner, we advocate for engagement through various channels. This includes proactive efforts such as making personalized calls to referrals and leads, as well as utilizing the expansive reach of social media platforms. By encouraging loan officers to adapt their approach to the unique preferences of each partner, we aim to facilitate dynamic and personalized interactions that contribute to the overall growth of their business networks.

Weekly Contact Management: In the realm of weekly contact management, precision is key for a loan officer. Proficiency in "Quickly Pre-Screening" prospective clients within the first 10 minutes of an initial call is crucial. This not only ensures efficient use of time but also enables the loan officer to deliver "Excellent Customer Service" to clients referred by a referral partner. By swiftly assessing client needs, the loan officer can tailor their approach and provide timely and relevant solutions. This commitment to excellence not only strengthens relationships with clients but also enhances the likelihood of receiving referrals both from satisfied clients and appreciative referral partners, contributing to the overall success of the loan officer's networking efforts.

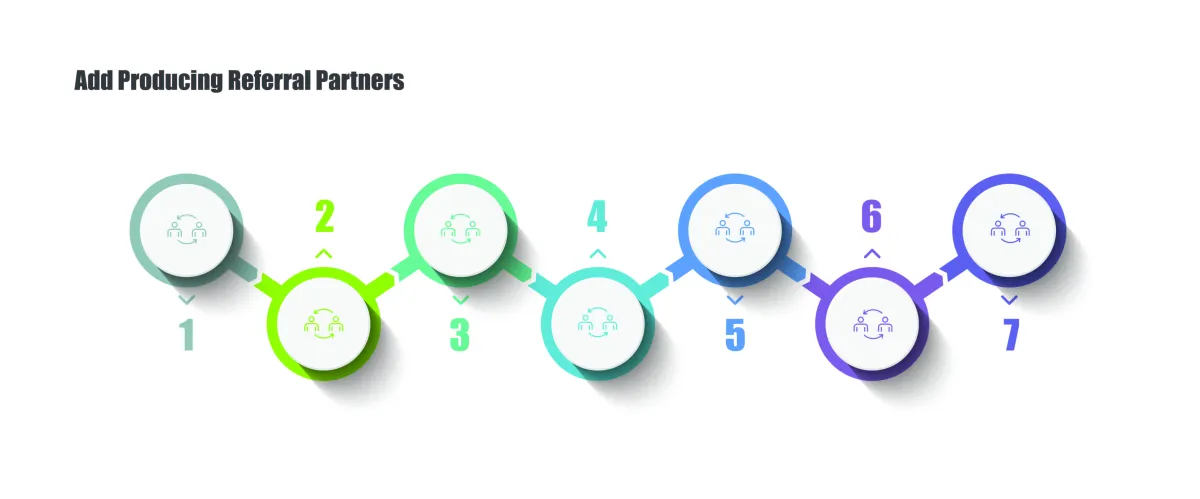

STEP 4: Adding Producing Referral Partners

In the fourth step of our strategy for adding productive referral partners, we recommend that loan officers diversify their network by connecting with referral partners across various productivity levels, including high, low, and non-producing partners. However, the emphasis is on focusing efforts based on the partner's production capacity, willingness, and ability to refer contacts in need of the loan officer's products or services. Our Marketing Success Managers stand as a valuable resource, offering assistance to high, low, and non-producing partners by providing additional leads and clients for referrals.

A key objective for loan officers is to consistently "Add" one to four new referral partners each month. Over the course of a year, the aim is for a loan officer to meet and add a minimum of 52 new referral partners to their network. This strategic expansion not only broadens the network but also plays a crucial role in helping a qualified loan officer achieve their closing and revenue goals. Furthermore, our Marketing Success Managers are equipped to present our branding and lead generation services, providing an additional avenue for loan officers to support their referral partners in growing their customer base. This collaborative approach ensures a dynamic and mutually beneficial network, fostering success for all parties involved.

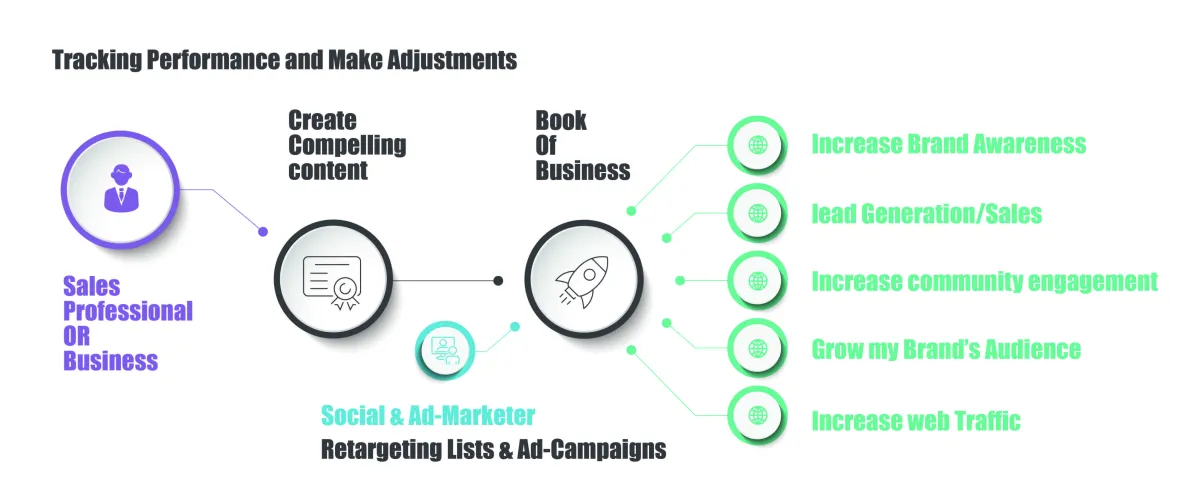

STEP 5: Setting-Up a Productive Business

In the fifth step of our strategy for setting up a productive business, we, as a third-party company, extend comprehensive support to real estate agents. Our services encompass crucial aspects such as branding, lead generation, lead conversion, and marketing-by-referral. The overarching goal is to empower our loan officer customers by assisting their entire network of agents in finding more leads and referrals, ultimately leading to increased revenue. It's important to note that these services are directly paid for by the agent, not the loan officer customer. We maintain a strict policy against loan officers paying for the products or services of their network of agents through our platform.

This approach is designed to benefit high, low, and non-producing real estate agents alike, providing them with the tools and resources necessary to run a more productive business. By enhancing their ability to find leads and referrals, these agents can seize valuable sales opportunities and collaborate effectively with loan officers, fostering a synergistic relationship that contributes to the overall success of both parties involved.

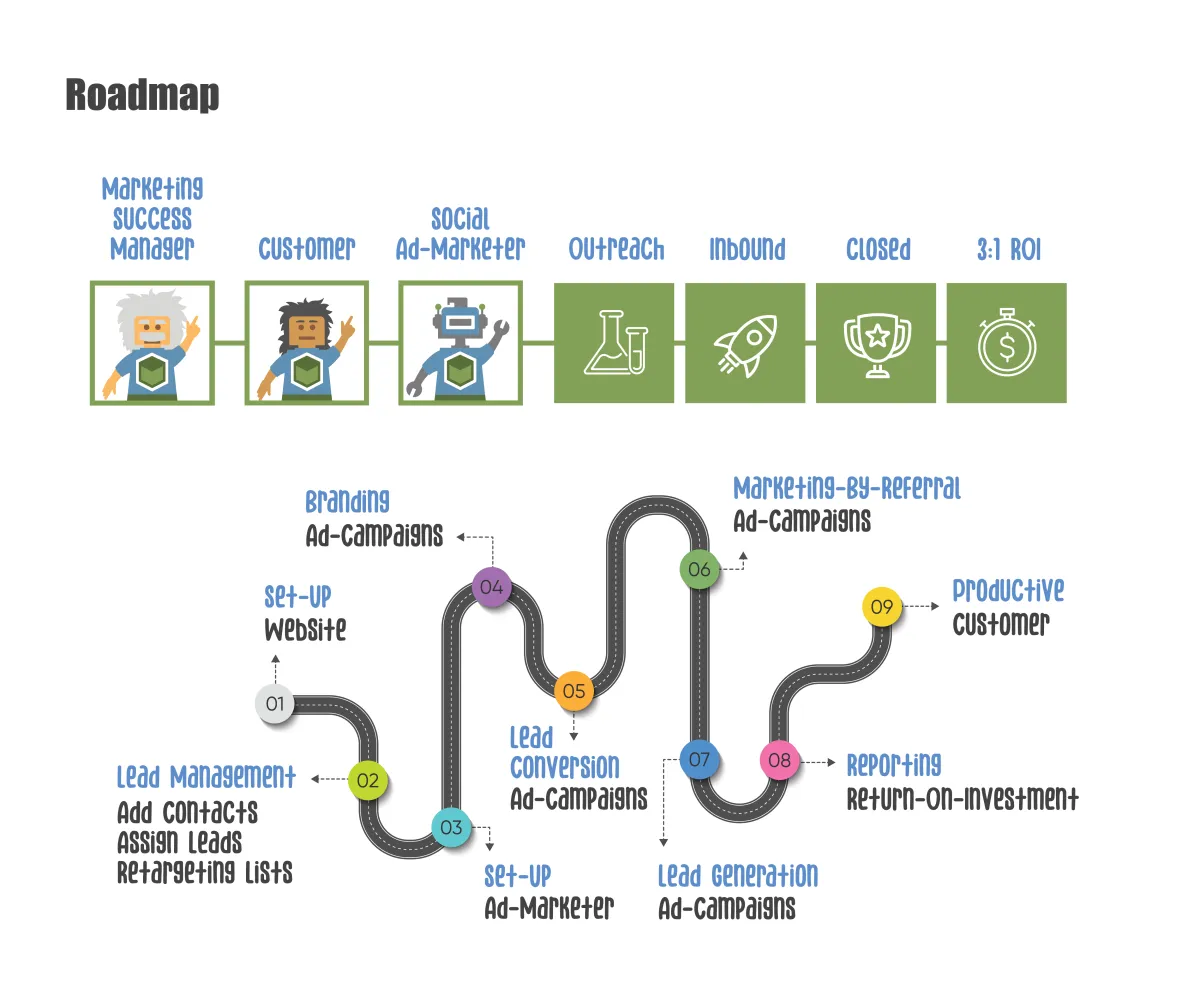

STEP 6: Roadmap

It's fairly easy for a likable loan officer to build a network of agent referral partners that are willing to refer them their leads/clients.

In the sixth step of our roadmap, we acknowledge that while a personable loan officer can easily establish a network of agent referral partners, not all partners may possess the leads or clients to refer. This is where our role as a third-party branding and lead generation agency becomes pivotal. Our focus is on providing tailored solutions to address this gap.

For agent referral partners lacking sufficient leads, we initiate a comprehensive approach. First, we assist them in crafting a compelling personal brand to strengthen their connection with existing clients, fostering client retention. Subsequently, we implement retargeting ads to enhance the conversion of sales opportunities into closed clients. Additionally, we design ad campaigns aimed at encouraging referral requests from their existing network of referral sources.

It's essential to note that our lead generation services are exclusively provided to our branding customers. This strategic alignment ensures that our customers receive targeted lead generation support, enhancing their ability to convert more clients from their lead generation strategies. By offering this integrated approach, we contribute to the overall success of loan officers and their agent referral partners, creating a roadmap for sustained growth and increased business opportunities.

Software & Networking Service: Monthly Fee: $350.00

Software & Networking Service: 30-Day Free Trial, then Monthly Fee $350.00 Features (Phone, Emails, SMS Texts, etc) with Usage Costs Not Included with Monthly Fee.

Software & Networking Service: Elevate your networking experience with our 30-Day Free Trial, followed by a Monthly Fee of $350. For networking professionals, this offer is designed to take your networking capabilities to new heights. Try it now and unlock the full potential of our software and networking service.

Software & Branding Service: Year Fee: $3,780.00

Make a proactive commitment to a year of software and networking service at a discounted yearly fee of $3,780.00.

If you're already convinced of our software's suitability, opt for our Annual Plan at $4,200.00 with a 10% discount, reducing it to just $3,780.00 for the year. Features (Phone, Emails, SMS Texts, etc) with Usage Costs Not Included with Monthly Fee.

Would you like to schedule a consultation with a marketing success manager?

We are here to help you run a profitable business.

Our customers use our software to easily share their content through SMS Texts, Emails, Website, Landing Pages, and Social Media. We focus on sharing content for Networking, Branding, Lead Generation, Lead Conversion, and Marketing-By-Referral.

Human Brain Box is for anyone that is looking to leverage software to attract, nurture, and convert their SOI, leads, sales opportunities, and qualified prospects into closed customers.

We invite you to schedule a day and time to speak with a marketing success manager.

Our marketing success managers are here to learn about your networking goals and present our products and services.

Would you be interested in having a Marketing Success Manager reach out to you to discuss our software and services? Feel free to fill out the form below, and we will be in touch with you soon.

I Want to Learn More About Software and Networking Services

I'm Interested In:

Title

If you were referred by someone, could you kindly share their information with us?

Our goal is to figure out which prospective customers have the pain that we are able to solve. We present our services to everyone, but only sell people that are a good fit for our business. We spend time interviewing prospective customers to find out about their business and goals. If we sign up people that are not a good fit for our agency, they will not continue as a customer. We can't solve everyone's pain, we only solve what we do. We lean into what we do right.

We must be authentic and make it very comfortable for people to become a customer. Our sales presentations explain what we do and the types of customers that are a good fit for our products and services. We are here to guide and give people perspectives on our products/services and how to compare alternatives. We want to educate our prospective customers, not sell. And know that if our product and services do not make sense for a prospective customer they will not want to buy.

We have found most of the time people don't know what to do and are drowning in information. They have a hard time making sense researching a company's benefit over another. At the center of our consultation is to help someone make the best choice for their business. By correctly presenting what we do and why we are a good fit.

When our marketing success manager presents what we do and a prospective customer does nothing. Usually, the presentation did not help them figure out what to do, so they end up doing nothing. If this happens. We do not try to sell our products or services at all during this conversation. It's about learning not selling.

Sometimes, our ideal customer has received such terrible solutions and burned so many times. They say ya right. We don't want to talk about our value. We want to show it. We don't want to say it's true, we have to prove it's true.

© Copyright 2024. Human Brain Box. All rights reserved.